Good day SINOVATORS!

It’s been over a year now since the release of SINOVATE Infinity Nodes, and the results are undeniable. In this article we are going to take a look at the coin economics for SIN, and examine how to time your investment to maximize ROI.

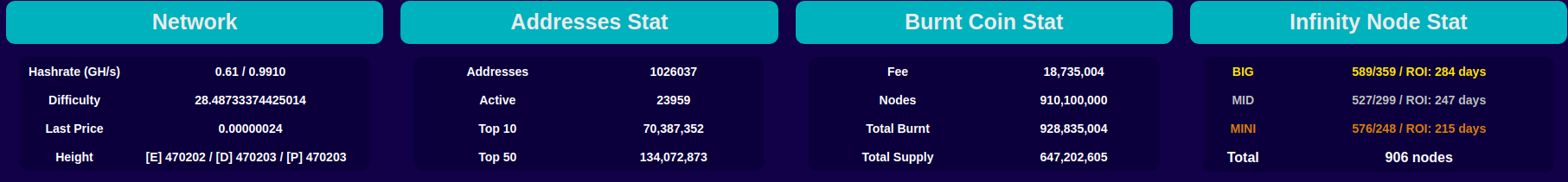

When the SINOVATE Infinity Nodes (SIN) started, there was an initial supply of 650,000,000 coins. Despite posting an ROI of over 100%, the coin supply nearly 15 months later is only 646,792,962! This is a remarkable achievement for any coin, yet alone in the Masternode sector, and confirms the economic theory behind SINOVATE. Such results are only made possible by burning and minting coins at an equal rate.

Coin “burning” is a colloquial term used in the crypto industry that refers to the permanent removal of coins from circulation. From the start, SINOVATE has been committed to finding new and inventive ways of burning their coins in an effort to control inflation and maintain coin value. In fact, the majority of SIN coins that have existed have been burned.

According to the SINOVATE explorer, a total of 928,835,609 coins have been burned, in contrast with the 646,792,962 that are in circulation at the time this article was written — representing over 65 % of all coins. These coins were burned primarily through transaction fees and collateral burning.

Burning and Earning

SINOVATE’s strategic economic model incentivizes investors to burn their coins and receive a return on investment on their burnings. In a clever twist on the traditional model which requires coins to be “locked” as collateral, Infinity Node collateral must be burned. Investors are able to burn 100k, 500k or 1M SIN coins in what are called MINI, MID, and BIG Infinity Nodes, respectively. Upon burning the required collateral, the investor will receive back their burned collateral with interest over a twelve month period. After twelve months the Infinity Node expires, and the investor has the option to burn more coins and renew their node.

Since only 2775 Sinovate coins are minted every two minutes, the number of new SIN coming into circulation on a daily basis is limited. This works out to about 1,998,000 SIN per day — or about 729,270,000 per year. These coins are divided as rewards amongst the Proof of Work miners, as well as the Infinity Nodes. A 10% portion is also delegated to the team as a development fee.

This means that the return on investment is a direct function of the number of Infinity Nodes that are active. Remember that since the collateral must be burned, the ROI must be at least 100% for investors to avoid taking a loss. However, keep in mind that as nodes expire, the ROI will increase (since the pot will be split into less pieces). Even if the ROI is less than 100% at the time collateral is burned and a node is started, it is likely to still become profitable throughout the year as more nodes expire.

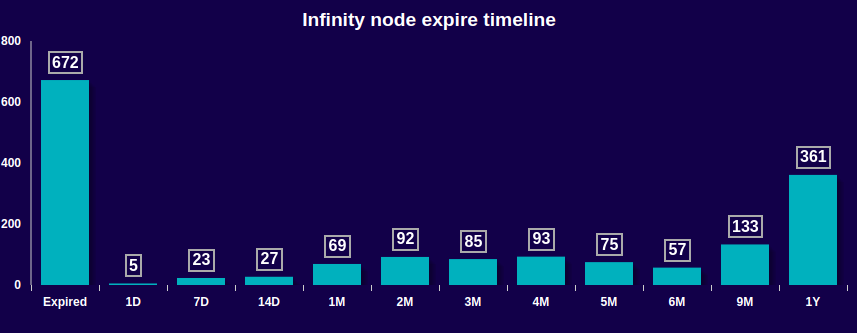

On the SINOVATE explorer dashboard, a chart is available that shows the upcoming expiration of nodes on the network. See the image below:

According to the chart, 7 nodes are set to expire tomorrow, followed by an additional 69 in the next week. In the next month alone 210 more Infinity Nodes are set to expire, which will certainly result in a reasonable increase in return on investment. By timing the start of a node to be right before a surge of expirations, an investor can maximize their possible returns over the life of their Infinity Node.

Since the SINOVATE supply has stayed relatively flat since the release of Infinity Nodes, by burning your collateral and receiving rewards, an investor actually increases their percent of ownership of all coins in circulation. This is in stark contrast with most Masternode and Proof of Stake coins, which only reward their investors by inflating the coin supply. For example, if someone burns 1,000,000 coins to start a BIG sin node, they are burning about 0.1515% of the total coin supply. Assuming an average yearly ROI of 130% and a flat coin supply, that investor will own about 0.1969% of the total coin supply at the expiration of their node.

As SINOVATE continues to develop its Incorruptible Data Storage function, the fees and increased transaction volume on the network could actually turn the inflation rate negative — meaning that the total supply of coins would actually decrease over a yearly time frame. This would only compound the positive benefits to investors further, as the coin value would be almost certain to increase in such a scenario.

Exciting things are ahead for SINOVATE. Stay tuned for more updates!

For more information and to learn how to get involved, please use the following links.

WebsiteDiscord . Telegram . Bitcointalk . Twitter . Facebook .Linkedin.Team.YouTube.Reddit.Instagram.

Author: Jonathan Lees

Recent Comments